It is very important to get a good investment plan for children’s education to their marriage. Because through this you can meet future needs. If you too are looking for an option to invest in the long term, then the public provident fund can be effective. It will provide your regular income source even after retirement. So what is the scheme and how can you invest in it, know the details.

15 Years PPF Investment Plan

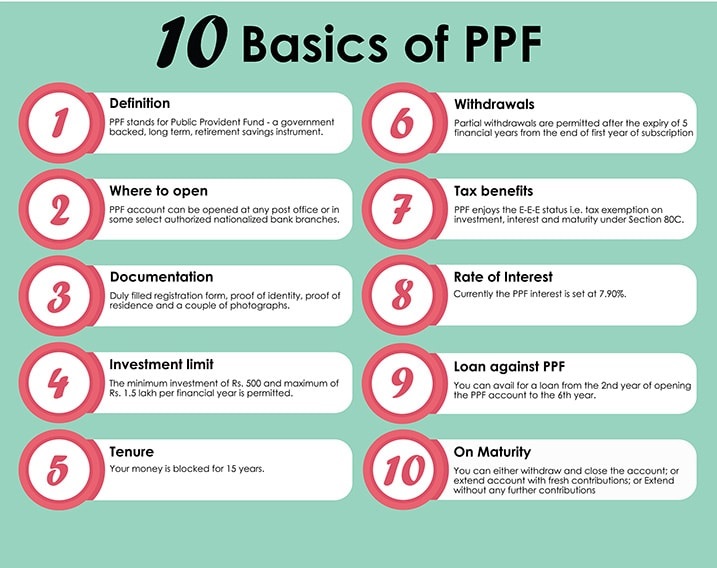

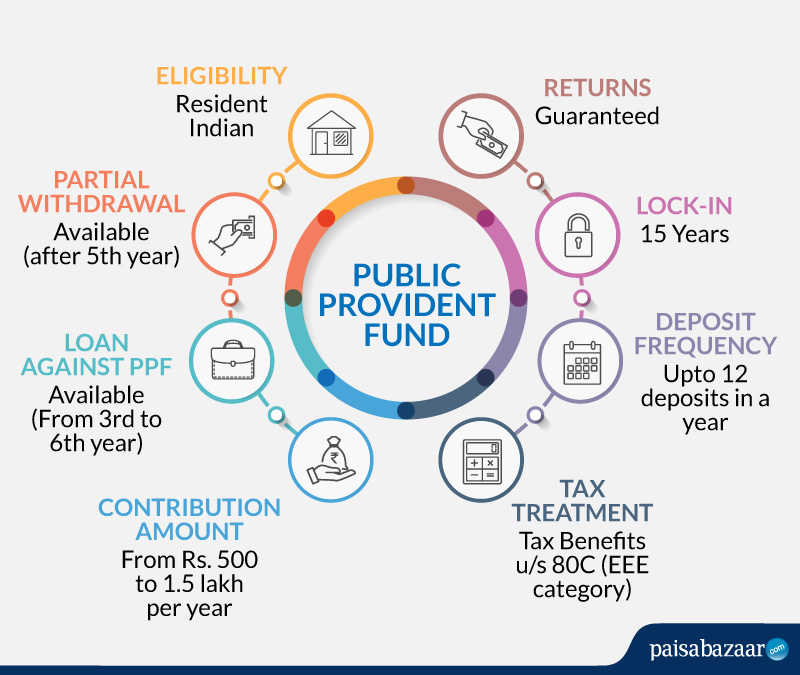

PPF is a good option for long term investment. It gets interested in up to 7.1 percent. Its maturity period is 15 years. However, it can be carried forward for 5–5 years. For this extension, Form H has to be submitted. Income tax is also exempt in this. PPF is one of the most suitable investment options for self-employed professionals and employees not in the realm of wealth.

How To Invest Your Money

If a person invests in it from the age of 25 to 30 years and he deposits 1.5 lakh rupees every year. In such a situation, after completing 15 years, if it is carried forward for 25 years, then he accumulated a total of 55.68 lakh rupees. If an interest of 7.1 percent is added on this, then the person will get about one crore rupees on maturity.