Almost every person wants to earn high returns from the investment that they have made in the company. This is the reason many regular and even new investors are taking the help of some reliable investment strategies that can easily provide high returns in the future. There is no such guaranteed strategy that will surely double up your invested amount but there is a concept that can help in predicting the time in which the money can be doubled. This rule is known as the Rule of 72 formula. The person needs to have proper knowledge about his concept if they want to make the best use of it.

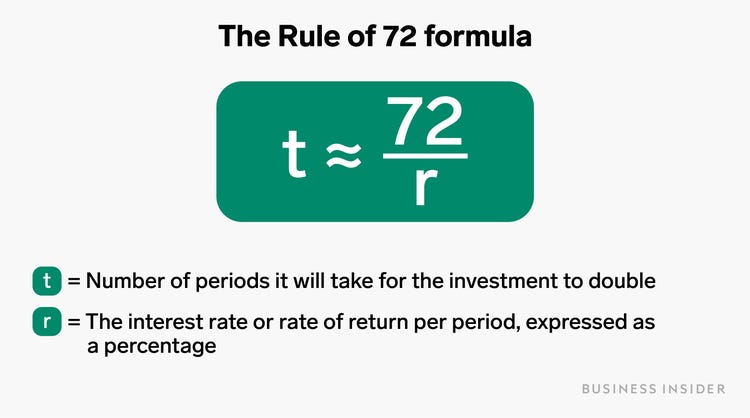

The Rule of 72 is like a mathematical formula that is used to estimate the time for your investment that it would take to get double the value of Rule 72, it also helps in estimating the annual compound rate of return which is required to double your investment. This concept was formulated by Luca Pacioli, an Italian mathematician.

The formula for Rule 72 has different concepts involved in it. Some of them are listed below:

- Doubling period: To calculate the approximate time for your investment to get double in value. There is a need for you to divide 72 by the expected annual compound rate of return.

Doubling period = 72/ expected annual compounded rate of return.

Always consider a whole number as the rate of return and never use decimal numbers in the calculation.

- The required rate of return: Just to calculate the required rate of return, there is a need to double your investment for a set period. Further, you need to divide it by 72 by the number of years that you plan to hold your investment.

The required rate of return = 72/ number of years

There are many ways where the rule of 72 can be used. Let’s have a look at them.

- Investment planning: If an investor wants to be sure about their investment and wants to make plans that can yield some great results. There is a need to use the rule of 72 for proper investment planning. The use of the formula will help you provide a rough idea about how much amount needs to be invested for how much time to get great returns in the end. Mostly the calculations done using this formula will always lead to exact amounts that you can expect in the future.

- Interest on the borrowed amount: The use of rule 72 will help you to roughly predict the time frame in which you can get the interest on the borrowed amount. The use of this formula will help you to reach the approximate amount at the end of the year.

There are some conditions, according to which Rule 72 works. Let’s have a look at them.

- The rate of return must be low typically between 6- 10%.

- Investors just need to make a one-time investment and all the income will be generated just by reinvesting the investment for compounding returns.

- There needs to be a fixed rate of returns.

Once all these conditions to the rule of 72 are satisfied, it can help in giving you the exact number that can come out to be an accurate doubling period. With time many investors are giving high importance to the rule of 72 as it helps in calculating the approximate number of years in which the investment can be easily doubled. Even with the help of this rule, it can help you to predict roughly the years of your portfolio which will surely help you in reaching your targets.

There might be some people that have confusion related to Rule 69, Rule 70, and Rule 72. All these have a major difference. out of all Rule 72 is the simplest one as it is considered to just simply compound the interest. But in Rule 69, there is continuous compounding interest. On the other hand, the Rule of 70 and even the rule of 72 help in calculating the exact time in which the investment would become double in its value.

Being an investor, you have to make all the right measures to know that your investments are done in the right way and it is going to only provide you with high returns in the future. So the quickest way to estimate your investment is using Rule 72. This rule will help you to know the annual compounding rate of return along with the compounding rate of return.

We all must understand the fact that the future is uncertain so better not to only rely on this formula but still do your research to know about the market better. the proper analysis and research about the market will only help you to make the investment decisions that will be fruitful for you in long run.